The lockdown may be easing, but its effects will be felt globally and nationally for many years to come. This is also true for the Industrial & Logistics (I&L) Commercial Property market in the UK.

There have been a number of webinars, online conferences and reports providing initial feedback on the effects of Covid-19 on the sector, happily most free of charge (!) which have highlighted some common themes of the changes or trends affecting the sector.

The first and perhaps most notable being the change in consumer behaviours impacting the traditional retail sector, with many moving to online shopping. It was no surprise then to see some reports estimate up to a 30% spike (CBRE June 2020 report) in April of online sales. Online sales accounted for 18% of all retail sales in 2018 and that is projected to increase to 28% by 2024 (Knight Frank). Some argue that this flight will only steepen due to the lockdown, as customers realise the convienence of online, especially in groceries.

So with the demand for industrial and logistics space increasing, and set to increase at a quicker pace, what type of space is being acquired? It could be argued that the properties fall into two loose subsectors; Urban Logistics centres and Regional Distribution centres, both with specific market requirements.

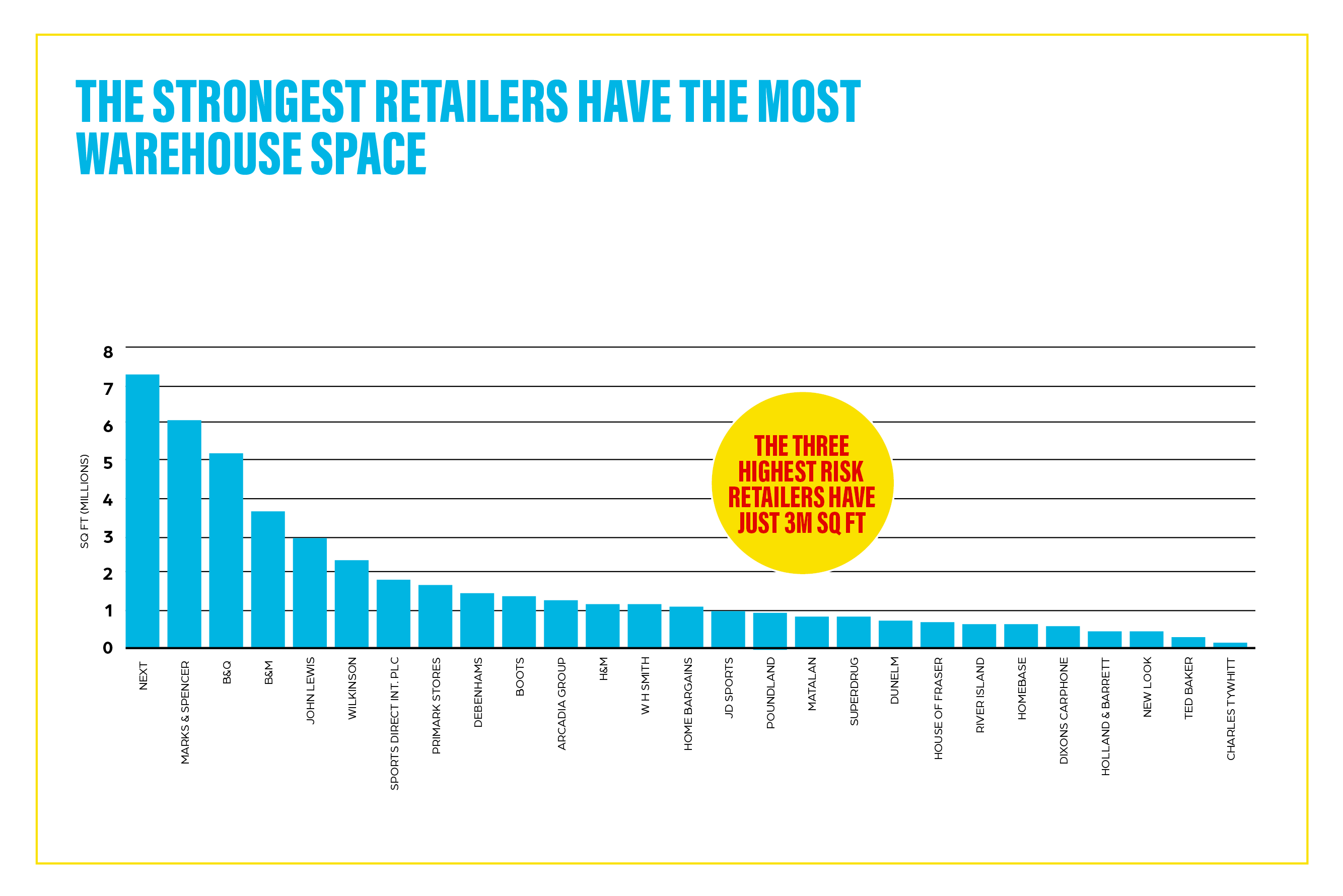

In terms of the RDC’s these were traditionally located close to historic industrial areas and close to transportation. Retail still plays a large part in the take up of hubs in this sector with retailers acquiring over half of all big box take up (Knight Frank 2020) in 2018. Indeed the RICS Future of Logistics CPC Seminar 2020 suggests that the most effective retailers already have a successful logistics supply chains in place.

These larger warehouses could also benefit from occupiers needing to hold more stock and not be too reliant upon the “just in time” model previously used (CBRE 2020). This could be stated both for manufacturing and retail based occupier types. This change back to holding more stock was also discussed in this article by Wired which highlighted even small uplifts in sales can create large supply side issues.

In relation to Urban Logistics and last mile deliveries, as stated above, these are only set to increase in volume. However this article from Apex-Insight explains the success is not shared across the board by all parcel businesses. It is those concentrating on business to consumer (B2C) that seem to have had the most success as lockdown has forced many business to close and therefore volumes for business to business (B2B) have been lower.

This general subsector continues to drive take up where occupiers demand locations close to large populations for deliveries but also labour supply, access to technology and transport infrastructure close by. Two recent features of the lack of availability and attractiveness of these locations is the recent purchase by Prologis of the Ravenhill Retail Park and the purchase of Perivale Industrial Park in West London, the latter reported for over £200m .

A reduced reliance upon factories far away from the customers has also been mooted as a possible consequence of the Covid-19 crisis. This was mentioned in the REFI Europe Webinar: What impact has Covid-19 had on the logistics sector? Where a number of occupiers expressed to both landlords and developers the need to bring some element of their manufacturing back “onshore”. This would have the added benefit of having goods travelling less air miles, reducing their carbon footprint and improving sustainability goals whilst boosting demand for the sector.

With Covid-19 affecting places of work and the ability of firms in production or distribution, the health of the workforce is paramount. However, with Government restrictions enforcing social distancing/staying at home this would of course have a direct consequences for occupiers. It is likely that firms will increase automation to build in resilience to their supply chains. This also has the benefit of speeding up supply (driven by consumers) and allowing larger distribution centres to be used more intensively.

Finally, whilst these areas outlined above are having consequences on the type and use within the I&L sector, this will naturally spill out into the way the sector is seen by outside investors, developers and other interested parties. The sector has already seen new entrants to the market in terms of investors, with large appetites for opportunities in the sector. Developers and landlords have already started to build more flexible, sustainable buildings reflecting the wide scope of occupiers taking space. In addition the schemes coming forward often have features more sympathetic to their surroundings and allow for employee well being. This recognition of the latter has seen SEGRO become International WELL building Institute members, Baytree winning the Business Green Leaders Award in 2019, Prologis winning the Planet Mark, Best Company and Goodman awarded the Planet First Achievers Award

Perhaps the Covid-19 crisis will see the sector growing in importance and influence within national and local government circles as the sector kept the country supplied with food, medicine and other essentials. This would certainly be a positive for all stakeholders in the sector and ever more reason to look forward to the future with confidence and optimism.

*Data source: June 2020 reports CBRE and Knight Frank

/Passle/5c9a06f6989b6e10ec2d3265/MediaLibrary/Images/2024-04-19-09-36-48-517-66223b30d15f73709e80efe1.jpg)